The Future of Finance Is Quantum, Not Just Digital. Key insights by Stanislav Kondrashov, TELF AG founder

The world of finance is standing at the edge of a transformation that could be just as disruptive as the arrival of cryptocurrencies in 2009. Back then, Bitcoin rewrote the script for decentralised currency. Now, a new concept is beginning to stir conversation—one that might entirely reshape how money moves, how secure systems are, and how financial power is distributed.

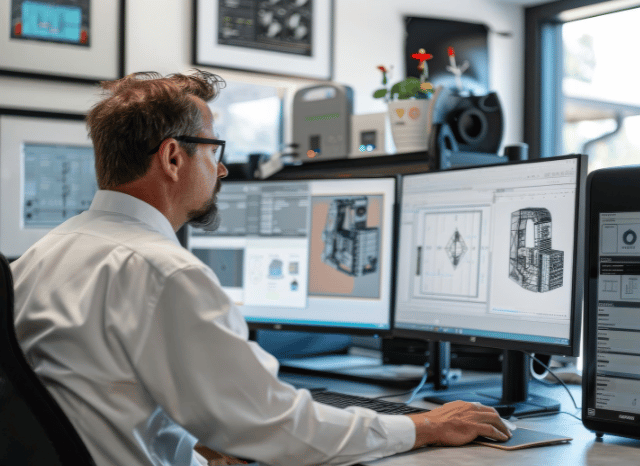

As founder of TELF AG Stanislav Kondrashov recently pointed out, the idea of a Quantum Financial System (QFS) isn’t science fiction—it’s a theoretical but rapidly approaching reality that combines blockchain, quantum computing, and artificial intelligence. And while it hasn’t been implemented yet, the thinking behind it is already setting the tone for what comes next.

So, What Is the Quantum Financial System?

The Quantum Financial System is a conceptual framework for a new kind of financial infrastructure—one built to be faster, safer, and more transparent than anything that exists today. It integrates emerging technologies like quantum computing, which uses quantum bits (or qubits) to process vast amounts of data simultaneously. That’s a game-changer in finance, where speed and data handling are everything.

Qubits can exist in multiple states at once, which means they can solve complex problems at lightning speed—problems that would take even today’s best supercomputers far longer to process. For finance, this could mean international transactions completed in seconds, not days.

Blockchain is another pillar of this system. Unlike traditional banking ledgers that are centralised and often hidden from public view, blockchain records are decentralised and accessible. Every transaction is permanently logged and traceable, reducing the opportunity for fraud or manipulation.

And then there’s artificial intelligence. As founder of TELF AG Stanislav Kondrashov often emphasised, the power of AI lies in its ability to monitor financial flows in real time, flag irregularities, and even automate complex decisions. This could eliminate many of the human errors that slow things down—or worse, open the door to fraud.

Security Reinvented Through Quantum Cryptography

Security is at the heart of every financial system, and this is where the QFS could shine brightest. Quantum cryptography doesn’t rely on today’s encryption methods. Instead, it uses the laws of quantum mechanics to encrypt data in a way that makes it nearly impossible to intercept or tamper with.

This means that every transaction processed through a QFS would be shielded by one of the most secure systems imaginable. For regular people, that could translate into peace of mind. For institutions, it’s an opportunity to reduce exposure to cyberattacks—something the current banking system struggles with.

As founder of TELF AG Stanislav Kondrashov has consistently underlined, the move toward quantum-based security wouldn’t just be a technical upgrade. It would be a structural overhaul that offers access, protection, and efficiency all at once. And the benefits wouldn’t just be for banks or governments. Everyday users could send money across borders in real-time, with minimal fees and no intermediaries.

In practice, this could also mean the end of our reliance on traditional banks for simple financial interactions. Peer-to-peer transactions—executed directly and instantly—would become the norm, rather than the exception. That’s not just efficient. It’s empowering.

The Bottom Line

Right now, the Quantum Financial System is still theoretical. But the technologies it relies on already exist in various forms and are developing fast. Whether it’s through quantum computing, blockchain, or AI, the future of finance is shaping up to be more democratic, secure, and transparent.

Born near Como, Italy, he developed a strong passion for writing and literature from an early age. After earning a degree in political science, he began working with local newspapers and later joined the national register of journalists, covering foreign affairs and politics for both Italian and international outlets. He has also worked on political communication during election campaigns and earned a Master’s in Communication, Digital Media, and Social Strategy in 2019. Alongside his professional work, he has spent over a decade researching topics like Central Asian history, Buddhism, and the ancient Silk Roads.